UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

![]()

20182021 ANNUAL MEETING OF SHAREHOLDERS

Dear Fellow Shareholders:

| | Dear Fellow Shareholders: On behalf of the Board of Trustees and employees of Eversource Energy, it is my pleasure to invite you to attend the virtual May 5, 2021 Annual Meeting of Shareholders of Eversource Energy. You can find additional information on how to participate in the Annual Meeting starting on the next page. I would first like to tell you how proud I am of what our team achieved in 2020 on behalf of our customers, communities, and investors under difficult circumstances. Eversource’s more than 9,000 employees faced unprecedented challenges from the global COVID-19 pandemic, responding to numerous storms and emergencies, advancing our clean energy and carbon neutrality goals, working to complete a strategic acquisition, and delivering strong financial results for our shareholders. As an essential service provider, Eversource plans for major disruptions and was ready to respond. We moved quickly to remote work, adopted new safety protocols for field-based employees and coordinated closely with our communities to perform our essential work. We proactively stopped customer disconnections for non-payment, established flexible payment plans, and set up a dedicated team to help small business customers apply for federal assistance. | | | ![[MISSING IMAGE: ph_jamesjudge1-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_jamesjudge1-bw.jpg) | |

Please seepandemic behind us in 2021. Whatever the accompanying Notice of Annual Meeting of Shareholdersyear brings, we know Eversource will remain a catalyst for clean energy and proxy statement for information on the matters to be acted upon at the meeting. Our meeting agenda will also includeinclusion and a discussion of the operations of the Eversource Energy system companies and an opportunity for your questions.

In 2017, we continued to achieve very positive financial and operating performance results:

Three of our Trustees, John S. Clarkeson, Charles K. Gifford, and Paul A. La Camera, will retire from the Board effective on the date of our Annual Meeting. We thank them for their exceptional service to the Board and the Company.

When I became your Chief Executive Officer in 2016, I set a goal for Eversource Energy to be known as the best energy company in the country by the year 2020. We made great progress last year toward achieving that goal, and intend to continue to make great progress in 2018.

4.3 million customers. On behalf of your Board of Trustees, I thank you for your continued support of Eversource Energy.

![[MISSING IMAGE: sg_jamesjudge-bw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/sg_jamesjudge-bw.jpg)

| | DATE: | | | Wednesday, May 5, 2021 | |

| TIME: |

|

March 23, 2018

![]()

|

| | | 10:30 a.m. Eastern Time | |

| PLACE: | |||

| | |||

You are entitled to vote at

Voting

Whether or not you plan toour transfer agent, Computershare) may attend the Annual Meeting it is important that yourby accessing the meeting center at http://www.meetingcenter.io/

Meeting Admission

You26, 2021. All shareholders are urged to vote and submit their proxies in advance of or your proxy are entitled to attendat the Annual Meeting.

March 23, 2018

Important Notice Regarding the Availability of Proxy Statement MaterialsConduct for the Annual Meeting of Shareholders tothat are available in the meeting center at the website address above.

TableBy Order of ContentsTrustees,![]() Richard J. Morrison

Richard J. Morrison

SecretaryMarch 26, 2021 PROXY STATEMENT SUMMARY1 Important Notice Regarding the Availability of Proxy Statement Materials for the Annual Meeting of Shareholders to be held on May 5, 2021. The Proxy Statement for the Annual Meeting of Shareholders to be held on May 5, 2021 and the 2020 Annual Report are available on the Internet at www.edocumentview.com/ES

| | | | | | 1 | | | |

| | | | | 1 | | | ||

| | | | | | | |||

| | | | | | | | ||

| | | | | | | |||

| | | | | | 5 | | | |

| | ||||||||

| | | | | 6 | | | ||

| | ||||||||

| | | | | 13 | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | |||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 22 | | ||

| | | | | | | | ||

| | | | | | 28 | | | |

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | ||||||||

| | | | | 31 | | | ||

| | ||||||||

| | | | ||||||

| | ||||||||

| | | |||||||

| | | | | | 33 | | | |

| | ||||||||

| | | | | 35 | | | ||

| | | | | | 35 | | ||

| | | | | 40 | | |||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 43 | | | |

| | | | | | 44 | | | |

| | | | | | 44 | | | |

| | | | | | 44 | | | |

| | | | | | 45 | | |

20182021 Proxy Statement i

| | ||||||||

| | | | | | | |||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | | | ||

| | | | | | 56 | | ||

| | | | | | | | ||

| | ||||||||

| | | | ||||||

| | ||||||||

| | | |||||||

| | | | | | 57 | | | |

| | | | | | 57 | | | |

| | | | | | 58 | | | |

| | | | | | | | ||

| | | | | | 60 | | ||

| | | | | | 61 | | ||

| | | | | | 62 | | ||

| | | | | | 62 | | ||

| | | | | | 64 | | ||

| | | | | | | | ||

| | | | | | | | ||

| | ||||||||

| | | |||||||

| | | 69 | | | ||||

| | ||||||||

| | | | | | | |||

| | | | | | | | ||

| | ||||||||

| | | |||||||

| | | 72 | | | ||||

| | | | | | | | ||

| | | | | | 74 | | | |

| | ||||||||

| | | | | 74 | | | ||

| | QUESTIONS AND ANSWERS ABOUT THE ANNUAL MEETING AND VOTING | | ||||||

| | | | | |||||

|

paper copy of this proxy statement, our 20172020 Annual Report, and a form of proxy or voting instruction card isare first being mailed or made available to shareholders on or about March 23, 2018.

| | | Annual Meeting of Shareholders | | | ||||||||

| | | Time and Date: | | | ||||||||

10:30 a.m., Eastern Time, on Wednesday, May | | |||||||||||

| ||||||||||||

| | | | | Online at: http://www.meetingcenter.io/258120406 Enter the 15-digit control number on the Proxy Card and Password: ES2021 | | | ||||||

| | | Record Date: | | | March 10, 2021 | | | |||||

| | Financial | | | Operational | | | Sustainability/ESG | |

| | • 2020 earnings per share equaled $3.55, and non-GAAP earnings per share equaled $3.64, which excludes transactional costs relating to the successful acquisition of the assets of Columbia Gas of Massachusetts. • Our Board of Trustees increased the annual dividend rate by 6.1 percent for 2020 to $2.27 per share, exceeding the Edison Electric Institute (EEI) Index companies’ median dividend growth rate of 4.5 percent. • Our Total Shareholder Return in 2020 was 4.5 percent, compared to negative 1.2 percent for the EEI Index companies. • We made progress in our Revolution Wind and Sunrise Wind offshore wind projects and are otherwise continuing to advance our clean energy financial opportunities through our offshore wind energy partnership with Ørsted. • Our Standard & Poor’s credit rating is A-. There is no other holding company in the EEI Index with a higher credit rating. | | | • On average, 2020 customer power interruptions were 19.2 months apart, and average service restoration time was 64 minutes, as calculated pursuant to industry standards; this performance ranks us in the top decile of the industry. • We met our 2020 established goals in safety performance, outperforming the utility industry, and in response to gas service calls. • We achieved constructive regulatory outcomes at both the state and federal levels. • We continued to add to our customer messaging programs, led the industry in the early implementation of customer service moratoria in response to the pandemic, implemented extended customer forgiveness and payment programs, and set up a dedicated team to help small business customers apply for COVID-19 related federal assistance. | | | • Progress on our carbon neutral goal by 2030, as well as the energy efficiency, offshore wind, large-scale solar installation, battery storage and electric vehicle infrastructure programs and initiatives we describe in this proxy statement have significantly advanced our long-term strategy of being a clean energy leader. • Our 2021 Trustee nominees include nine who have served on the Board for nine or fewer years, three who are women and four who are persons of color. • We were again recognized by a significant number of organizations for our leadership in energy efficiency, veteran and differently-abled person hiring, workplace diversity, investor relations, and ESG. • We continued our strong support of our communities through our corporate philanthropy and employee volunteer programs. • Our Corporate Governance Committee has been renamed the Governance, Environmental and Social Responsibility Committee, to reflect new charter responsibilities relating to all aspects of ESG. | |

|

|

was

| | | | | | | | | | | | | | | | | | | | | | | Board Committees | | |||||||||||||||||||||||||||

| | Trustee | | | Age | | | Trustee Since | | | Independent | | | Audit | | | Compensation | | | Governance, Environmental and Social Responsibility | | | Executive | | | Finance | | ||||||||||||||||||||||||

| | Cotton M. Cleveland | | | | | 68 | | | | | | 1992 | | | | | | Y | | | | | | | | | | | | | | | | | | C | | | | | | M | | | | | | M | | |

| | James S. DiStasio | | | | | 73 | | | | | | 2012 | | | | | | Y | | | | | | | | | | | | M | | | | | | | | | | | | M | | | | | | C | | |

| | Francis A. Doyle | | | | | 72 | | | | | | 2012 | | | | | | Y | | | | | | C | | | | | | M | | | | | | | | | | | | M | | | | | | | | |

| | Linda Dorcena Forry | | | | | 47 | | | | | | 2018 | | | | | | Y | | | | | | | | | | | | | | | | | | M | | | | | | | | | | | | M | | |

| | Gregory M. Jones | | | | | 63 | | | | | | 2020 | | | | | | Y | | | | | | M | | | | | | | | | | | | | | | | | | | | | | | | M | | |

| | James J. Judge | | | | | 65 | | | | | | 2016 | | | | | | N | | | | | | | | | | | | | | | | | | | | | | | | C | | | | | | | | |

| | John Y. Kim | | | | | 60 | | | | | | 2018 | | | | | | Y | | | | | | M | | | | | | M | | | | | | | | | | | | | | | | | | | | |

| | Kenneth R. Leibler | | | | | 72 | | | | | | 2006 | | | | | | Y | | | | | | M | | | | | | | | | | | | | | | | | | | | | | | | M | | |

| | David H. Long | | | | | 60 | | | | | | 2019 | | | | | | Y | | | | | | | | | | | | M | | | | | | M | | | | | | | | | | | | | | |

| | William C. Van Faasen | | | | | 72 | | | | | | 2012 | | | | | | Y | | | | | | | | | | | | C | | | | | | M | | | | | | M | | | | | | | | |

| | Frederica M. Williams | | | | | 62 | | | | | | 2012 | | | | | | Y | | | | | | M | | | | | | | | | | | | M | | | | | | | | | | | | | | |

| | | | | Board Committees | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Trustee | Age | Trustee Since | Independent | Audit | Compensation | Corporate Governance | Executive | Finance | ||||||||

| | | | | | | | | | | | | | | | | |

Cotton M. Cleveland | 65 | 1992 | Y | | | M | | M | ||||||||

Sanford Cloud, Jr. * | 73 | 2000 | Y | M | C | M | ||||||||||

James S. DiStasio | 70 | 2012 | Y | | M | | M | C | ||||||||

Francis A. Doyle | 69 | 2012 | Y | C | M | M | ||||||||||

James J. Judge | 62 | 2016 | N | | | | C | | ||||||||

John Y. Kim | 57 | 2018 | Y | M | M | |||||||||||

Kenneth R. Leibler | 69 | 2006 | Y | M | | | | M | ||||||||

William C. Van Faasen | 69 | 2012 | Y | M | M | |||||||||||

Frederica M. Williams | 59 | 2012 | Y | M | | | | M | ||||||||

Dennis R. Wraase | 73 | 2010 | Y | M | M | |||||||||||

| | | | | | | | | | | | | | | | | |

2018 Proxy Statement �� 1

|

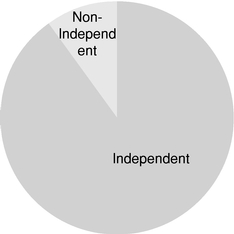

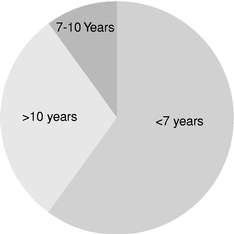

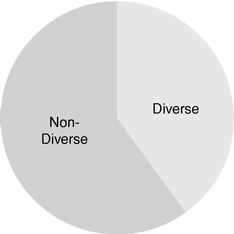

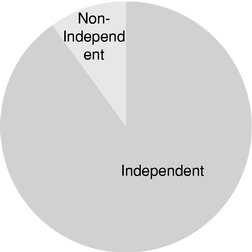

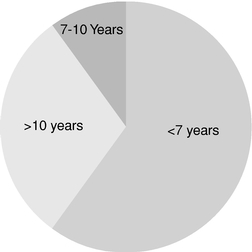

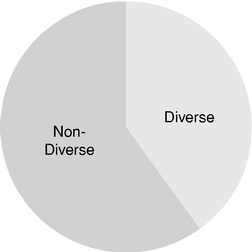

Independence, Tenure and Diversity

Of our eleven nominees, ten nominees, sixare independent, nine have served on the Board for sevennine or fewer years, three are women, and four are women and/or persons of color, and nine are independent.color. Please see the sections

marked "Selection in Item 1 Election of Trustees," "Trustee under the captions

|  |  |

|

We are asking shareholders to approve the compensation of the Company'sCompany’s Named Executive Officers, as disclosed pursuant to the compensation disclosure rules of the Securities and Exchange Commission (SEC). WeAs noted in the Summary of 2020 Accomplishments and elsewhere in this proxy statement, we achieved excellent financial and operating performance results in 2017,2020, and our total shareholder return hascontinues to consistently outperformed outperform

We met or exceeded challenging goals established for 2017 and achieved very positive results, including:

2 2018 Proxy Statement

|

We are asking shareholders to approve the 2018 Eversource Energy Incentive Plan (2018 Plan). Our Board of Trustees and our Compensation Committee approved the 2018 Plan, subject to shareholder approval. Grants under the 2018 Plan will not become effective unless and until the 2018 Plan is approved by our shareholders. The material features of the 2018 Plan are

described under "Summary of the 2018 Plan" in Item 3 on pages 63 - 68.

Our Board believes that the 2018 Plan will promote the interests of our shareholders and is consistent with principles of good corporate and executive compensation governance. Please see pages 63 - 68 andAppendix A.

|

Our Audit Committee has selected Deloitte & Touche LLP to serve as our independent registered public accounting firm for the year ending December 31, 2018.2021. The Board is seeking shareholder ratification of this selection. Please see pages 69 - 71.

The Board of Trustees recommends that shareholders vote FOR Items 1, 2, 3 and 4.

|

In 2017, we continued to achieve very positive financial and operational performance results. The following are highlights of some of our most important accomplishments in 2017:

2017 Financial Summary

2017 Operational Summary

2018 Proxy Statement 3

| | The Board of Trustees recommends that shareholders vote FOR Items 1, 2 and 3. | | |

|

What we DO:

What we DON'T do:

4 20182021 Proxy Statement

|

Eastern Time.

“FOR” or "AGAINST" the“AGAINST” a nominee or item or you may abstain from voting on the item.

20182021 Proxy Statement 5

TableItem 1: Election of ContentsTrustees

|

“Selection of Trustees", "TrusteesTrustees,” “Trustee Qualifications, Skills and Experience"Experience” and "Evaluation“Evaluation of the Board and Board Refreshment"Refreshment” beginning on page 12.13. Each nominee has indicated to our Lead Trustee that he or shethey will stand for election and will serve as a Trustee if elected. The affirmative vote of the holders of a majority of the common shares outstanding as of the record date will be required to elect each nominee. This means that each nominee must receive the affirmative vote of the holders of more than 50%50 percent of the total common shares outstanding. You may either vote "FOR"“FOR” or "AGAINST"“AGAINST” all, some, or none of the Trustees, or you may abstain from voting. Broker non-votes and abstentions will be counted in the determination of a quorum and will have the same effect as a vote against a nominee.

The Board of Trustees recommends that shareholders vote FOR the election of the nominees listed below.

| | | The Board of Trustees recommends that shareholders vote FOR the election of the nominees listed below. | | |

![[MISSING IMAGE: ph_cottoncleveland-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_cottoncleveland-bwresized.jpg)

Cotton M. Cleveland

![[MISSING IMAGE: ph_jamesdistasio-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_jamesdistasio-bwresized.jpg)

BACKGROUND

Mr. Cloud has been Chairman and Chief Executive Officer of The Cloud Company, LLC, a real estate development and business investment firm, since 2005. Mr. Cloud served as past President and Chief Executive Officer of the National Conference for Community and Justice from 1994 to 2004, was a former partner at the law firm of Robinson and Cole from 1993 to 1994, and served for two terms as a state senator of Connecticut. He was Vice President of Corporate Public Involvement and Executive Director of the Aetna Foundation from 1986 to 1992 and has served as Chairman of the Connecticut Health Foundation and continues as a member of its Board. Mr. Cloud served as a director of The Phoenix Companies, Inc. from 2001 to 2016 and is currently a director of Ironwood Mezzanine Fund, L.P. He is also a director of the MetroHartford Alliance, Inc. and the University of Connecticut Health Center. In addition, Mr. Cloud is a member of the Board of Trustees of the University of Connecticut and serves as director of its Thomas J. Dodd Center for Human Rights. Mr. Cloud received a B.A. degree from Howard University, a J.D. degree cum laude from the Howard University Law School, and an M.A. degree in Religious Studies from the Hartford Seminary.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Cloud has significant policy-making level experience in business and financial affairs as a business executive and as a director of several publicly-traded and privately-held companies. He provides the Board with great benefits from his experience as a law firm partner and Connecticut state senator and through his significant ties and service to the City of Hartford and the State of Connecticut. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Cloud should continue to serve as a Trustee.

2018 Proxy Statement 7

|

James S. DiStasio

![[MISSING IMAGE: ph_francisdoyle-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_francisdoyle-bwresized.jpg)

Francis A. Doyle

![[MISSING IMAGE: ph_lindaforry-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_lindaforry-bwresized.jpg)

TableItem 1: Election of ContentsTrustees

![[MISSING IMAGE: ph_gregjones-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_gregjones-bwresized.jpg)

![[MISSING IMAGE: ph_jamesjudge1-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_jamesjudge1-bwresized.jpg)

![[MISSING IMAGE: ph_johnkim1-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_johnkim1-bwresized.jpg)

John Y. Kim

![[MISSING IMAGE: ph_kennethrleiblerk-bwrz.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_kennethrleiblerk-bwrz.jpg)

2018 Proxy Statement 9

|

Kenneth R. Leibler

![[MISSING IMAGE: ph_longdavid-bwresized.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_longdavid-bwresized.jpg)

![[MISSING IMAGE: ph_williamvanfaasen-bwrz.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_williamvanfaasen-bwrz.jpg)

10 20182021 Proxy Statement

![[MISSING IMAGE: ph_fredericawilliams1-bwrz.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/ph_fredericawilliams1-bwrz.jpg)

Frederica M. Williams

Dennis R. Wraase

BACKGROUND

Mr. Wraase served as Chairman of the Board, Chief Executive Officer and a director of Pepco Holdings, Inc. (PHI), an energy delivery company in the mid-Atlantic region, until his retirement in June 2009. He was elected chairman of PHI in 2004, became Chief Executive Officer in 2003 and served as a director from 1998 to his retirement. He previously served as the President of PHI from 2001 to 2008 and Chief Operating Officer from 2002 to 2003. He is a member of the Financial Executives Institute and the American Institute of Certified Public Accountants. Mr. Wraase currently serves as the Executive-In-Residence at the Center for Social Value Creation at the Robert H. Smith School of Business, University of Maryland. He is also currently a director of the University of Maryland System Foundation. Mr. Wraase previously served as director of the Edison Electric Institute, The Association of Edison Illuminating Companies and the Institute for Electric Efficiency, and as the President of the Southeastern Electric Exchange. Mr. Wraase received a B.S. degree in Accounting from the University of Maryland and an M.S. degree in Business Financial Management from The George Washington University.

QUALIFICATIONS, SKILLS AND EXPERIENCE

Mr. Wraase brings to the Company considerable utility industry knowledge and experience gained through his career of service at PHI. He has significant policy-making level experience in regulated businesses as well as in capital and financial markets, credit markets, financial reporting and accounting, and risk assessment. He is also a certified public accountant. Based on these qualifications, skills and experience, the Board of Trustees determined that Mr. Wraase should continue to serve as a Trustee.

2018 Proxy Statement 11

|

|

James J. Judge is our Chairman, President and Chief Executive Officer. Sanford Cloud, Jr.William C. Van Faasen serves as our Lead Trustee.

the Board members; participates with the Compensation Committee, which he Chairs, in its evaluation of the Chief Executive Officer; and provides ongoing information to the Chief Executive Officer about his or her performance. He also attends all Committee meetings.

|

| | | Trustees should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our shareholders. They must also have an inquisitive and objective perspective, practical wisdom and mature judgment. The Board should represent diverse experience at policy-making levels in business, government, education, community and charitable organizations, as well as areas that are relevant to our business activities. The Governance, Environmental and Social Responsibility Committee also seeks diversity in gender, ethnicity and personal background when considering Trustee candidates. | | |

Trustees should possess the highest personal and professional ethics, integrity and values, and be committed to representing the long-term interests of our shareholders. They must also have an inquisitive and objective perspective, practical wisdom and mature judgment. The Board should represent diverse experience at policy-making levels in business, government, education, community and charitable organizations, as well as areas that are relevant to our business activities. The Corporate Governance Committee also seeks diversity in gender, ethnicity and personal background when considering Trustee candidates.

Applying these criteria and those noted elsewhere in this proxy statement, the Corporate Governance, Environmental and Social Responsibility Committee considers Trustee

acting on the recommendation of the Corporate Governance Committee, the Board of Trustees elected John Y. Kim to the Board effective January 1, 2018.

As part of the annual nomination process, for re-election, the Corporate Governance, Environmental and Social Responsibility Committee reviews the independence, qualifications, experience, attributesskills and skillsexperience of each nominee for Trustee and reports its findings to the Board. At its February 7, 20189, 2021 meeting, the Corporate Governance, Environmental and Social Responsibility Committee and the Board of Trustees determined that each Trustee (except our Chief Executive Officer) is independent, that each Trustee possesses the highest personal and professional ethics, integrity and values, and that each Trustee remains committed to representing the long-term interests of our shareholders. The Committee'sCommittee’s review also focused on each Trustee'sTrustee’s experience at policy-making levels in business, government, education, community and charitable organizations, and other areas relevant to our business activities, as described below. Based on this review, the Committee advised the Board on February 7, 20189, 2021 that each of the Trustees was qualified to serve on the Board under the Corporate Governance Guidelines.

12 20182021 Proxy Statement

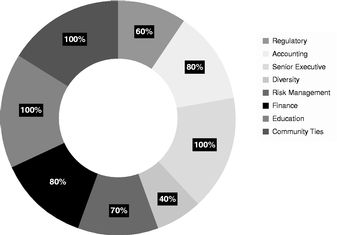

Trustee Qualifications, Skills and Experience |

|

Regulatory Experience. Each of our utility subsidiaries is regulated in virtually all aspects of its business by various federal and state agencies, including the SEC, the Federal Energy Regulatory Commission, and various state and/or local regulatory authorities with jurisdiction over the industry and the service areas in which each subsidiary operates. Accordingly, the Board values the policy-making level experience in a heavily regulated industry that several of our Trustees possess.

Accounting Experience.. As a publicly-traded electric, gas and water holding company whose companies are subject to very substantial federal, state and accounting industry rules, it is especially important that the Board have significant accounting experience. Accurate and complete financial reporting, financing, auditing and internal controls are critical to our success. We expect all of our Trustees to be literate in financial statements and financial reporting processes. Several of our

Trustees are career accounting and financial executives andwho provide us with superior strength in the Board'sBoard’s oversight of this important element of the Board'sBoard’s responsibilities.

Finance Experience. The vast majority of our ongoing capital program is expected to be funded through cash flows provided by operating activities as well as new debt issuances and, less frequently, equity issuances. As a result, the Board highly values the policy-making level experience and understanding of capital and financial markets, accounting and financial reporting, and credit markets that many of our Trustees have acquired.

Education/Community and Charitable Organization Involvement. Public utility companies have a unique position and role in the communities they serve beyond

2018 Proxy Statement 13

|

thatGovernance of most corporations. The Board supports and encourages educational opportunities, community involvement and development, and philanthropic goals and activities. The Eversource Energy Foundation, Inc. was established in 1998 to focus on our community investments

![[MISSING IMAGE: tm212409d1-pc_skillscir4clr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-pc_skillscir4clr.jpg)

Community Ties.Tenure We operate New England's largest energy delivery system in three different states. Because a majority of our Trustees also reside in our service territory, they not only have ties to local communities, but they understand our customers' needs.

Our Board's Qualifications, Skills and Experience

Independence, Tenure and Diversity

Of our eleven nominees, ten nominees, sixare independent, nine have served on the Board for sevennine or fewer years, three are women and four are women and/or persons of color,color. We believe that the mix of longer-tenured Trustees and nine are independent.

14 2018 Proxy Statement

| ![[MISSING IMAGE: tm212409d1-pc_independbw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-pc_independbw.jpg) | | | ![[MISSING IMAGE: tm212409d1-pc_ethniebw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-pc_ethniebw.jpg) | |

| ![[MISSING IMAGE: tm212409d1-pc_genderbw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-pc_genderbw.jpg) | | | ![[MISSING IMAGE: tm212409d1-pc_tenurebw.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-pc_tenurebw.jpg) | |

Board also annually review the independence, performance and qualifications of each Trustee prior to nominations being made for an additional term. These reviews are discussed by the Committee, following which it makes recommendations to the Board regarding nominees for election as Trustees.

Our Board has an average tenure of nine years. We believe that the mix of longer tenured Trustees and recently elected Trustees provides for the kind of balance that contributes to the overall effectiveness of the Board, and that strict restrictions on the length of time a Trustee serves on the Board are not warranted.

|

The Corporate Governance Guidelines are available on our website at the Internet address appearing in the Trustee Independence section on page 24. The committee charters are available on our website at the Internet addresses appearing in the committee descriptions below. Copies of these documents are available to any shareholder upon written request to our Secretarycommittees. These charters can be found at the address set forth on page 72 of this proxy statement. The functions of these Committees are described in the paragraphs following the table. The table below shows the current committee membership:

2018 Proxy Statement 15

|

|

| ||||||||||

| | ||||||||||

Members: | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

Francis A. Doyle, Chair | ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| ||||||||||

| | | | The Audit Committee is responsible for oversight of the Company’s financial statements, the internal audit function, and compliance by the Company with legal and regulatory requirements. The Committee also oversees: • The appointment, compensation, retention and oversight of our independent registered public accounting firm. • The independent registered public accounting firm’s qualifications, performance and independence, as well as the performance of our internal audit function. • The review of guidelines and policies that govern management’s processes in assessing, monitoring and mitigating major financial risk exposures. • Financial reporting and review of accounting standards and systems of internal control. • Significant accounting policies, management judgments and accounting estimates, and earnings releases. The Audit Committee has sole authority to appoint or replace the independent registered public accounting firm (for which it seeks shareholder ratification), and to approve all audit engagement fees and terms. The Committee meets independently with the internal audit staff, the independent registered public accounting firm, management, and then solely as a Committee, at least quarterly. Following each Committee meeting, the Audit Committee reports to the full Board. The Audit Committee met six times during 2020, including the annual joint meeting with the Finance Committee. Additional information regarding the Audit Committee is contained in Item 3 of this proxy statement beginning on page 71. Financial Expertise: Each member of the Audit Committee meets the financial literacy requirements of the New York Stock Exchange (NYSE), the SEC and our Corporate Governance Guidelines. The Board has affirmatively determined that Mr. Doyle is an “audit committee financial expert,” as defined by the SEC. Independence: The Board has determined that each member of the Audit Committee meets the independence requirements of the NYSE, SEC and our Corporate Governance Guidelines. | | |

| | | Members: William C. Van Faasen, Chair James S. DiStasio Francis A. Doyle John Y. Kim David H. Long | | | | The Compensation Committee is responsible for the compensation and benefit programs for all executive officers of Eversource Energy and has overall authority to establish and interpret our executive compensation programs. The Compensation Committee also: • Reviews our executive compensation strategy, evaluates components of total compensation, and assesses performance against goals, market competitive data and other appropriate factors, and makes compensation-related decisions based upon Company and executive performance. • Reviews and recommends to the Board of Trustees the compensation of the non-employee members of the Board. • Reviews and approves corporate goals and objectives relevant to the Chief Executive Officer’s compensation and, with the participation of the Lead Trustee and subject to the further review and approval of the independent Trustees, evaluates the performance of the Chief Executive Officer in light of those goals and objectives. • In collaboration with the Chief Executive Officer, oversees the evaluation of executive officers and engages in the succession planning process for the Chief Executive Officer and other executives. • Has the sole authority to select and retain experts and consultants in the field of executive compensation to provide advice to the Committee with respect to market data, competitive information, and executive compensation trends. • Retains an independent compensation consulting firm to provide compensation consulting services solely to the Compensation Committee. Following each Committee meeting, the Compensation Committee reports to the full Board. The Compensation Committee met four times during 2020. For additional information regarding the Compensation Committee, including the Committee’s processes for determining executive compensation, see the CD&A beginning on page 35. Independence: The Board has affirmatively determined that each member of the Compensation Committee meets the independence requirements of the NYSE, the SEC, and our Corporate Governance Guidelines. | | |

| | | Members: James J. Judge, Chair Cotton M. Cleveland James S. DiStasio Francis A. Doyle William C. Van Faasen | | | | The Executive Committee is empowered to exercise all the authority of the Board, subject to certain limitations set forth in our Declaration of Trust, during the intervals between meetings of the Board. Following each Committee meeting, the Executive Committee reports to the full Board. The Executive Committee did not meet in 2020. Independence: Except for Mr. Judge, who is the Company’s Chairman, President and Chief Executive Officer, each member of the Executive Committee is independent. | | |

| | Members: James S. DiStasio, Chair Cotton M. Cleveland Linda Dorcena Forry Gregory M. Jones Kenneth R. Leibler | | | | The Finance Committee assists the Board in fulfilling its oversight responsibilities relating to financial plans, policies and programs for Eversource Energy and its subsidiaries. The Finance Committee also: • Reviews the Company’s plans and actions to assure liquidity; its financial goals and proposed financing programs modifying the Company’s capital structure; its financing programs, including but not limited to the issuance and repurchase of common and preferred shares, long-term and short-term debt securities and the issuance of guarantees; and its operating plans, budgets and capital expenditure forecasts. • Reviews the Company’s Enterprise Risk Management (ERM) program and in conjunction with other Committees of the Board, practices to monitor and mitigate cyber, physical security and other risk exposures. • Reviews and recommends the Company’s dividend policy, as well as new business ventures and initiatives which may result in substantial expenditures, commitments and exposures. • Conducts an annual review of counter-party credit policy, insurance coverages and pension plan performance. Following each Committee meeting, the Finance Committee reports to the full Board. The Finance Committee met four times during 2020, including the annual joint meeting with the Audit Committee. Independence: Each member of the Finance Committee is independent, and while the Committee is not specifically subject to NYSE or SEC independence regulations, each member meets the independence criteria set forth in the NYSE and SEC regulations and our Corporate Governance Guidelines. | | |

The Audit Committee consists of Mr. Clarkeson, Mr. Doyle (Chair), Mr. Kim, Mr. Leibler, Mr. Van Faasen and Ms. Williams. The Audit Committee meets independently with the internal audit staff, the independent registered public accounting firm and management at least quarterly.

Following each Committee meeting, the Audit Committee reports to the full Board. The Audit Committee reviews and evaluates the independent registered public accounting firm's activities, procedures and recommendations to assist the Board in monitoring the integrity of our financial statements, the independent registered public accounting firm's qualifications and independence, the performance of our internal audit function and independent registered public accounting firm, and our compliance with legal and regulatory requirements. The Committee periodically discusses the guidelines and policies that govern management's processes for assessing, monitoring and mitigating major financial risk exposures. The Audit Committee also reviews the Company's significant accounting policies, management judgments and accounting estimates, earnings releases, financial statements and systems of internal control. The

Audit Committee has the sole authority to select and replace the independent registered public accounting firm and is directly responsible for their compensation and Board oversight of their work. Each member of the Audit Committee meets the financial literacy requirements of the New York Stock Exchange (NYSE), the SEC and our Corporate Governance Guidelines. The Board has affirmatively determined that Mr. Doyle is an "audit committee financial expert," as defined by the SEC. Each member of the Audit Committee also meets the independence requirements of the NYSE, SEC and our Corporate Governance Guidelines. No member of the Audit Committee is employed by Eversource Energy or its subsidiaries. Additional information regarding the Audit Committee is contained in Item 4 of this proxy statement. A copy of the Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-committee-charters/audit-committee. The Audit Committee met five times during 2017, and also met once with the Finance Committee in a meeting held in April 2017 at which the Committees discussed several issues relating to risk, and in particular, enterprise, cyber and system security risk.

16 20182021 Proxy Statement

|

The Compensation Committee consists of Mr. Clarkeson, Mr. Cloud, Mr. DiStasio, Mr. Gifford (Chair), Mr. Kim, Mr. Van Faasen and Mr. Wraase. The Compensation Committee is responsible for the compensation and benefit programs for all executive officersGovernance of Eversource Energy

| | | Members: Cotton M. Cleveland, Chair Linda Dorcena Forry David H. Long William C. Van Faasen Frederica M. Williams | | | | The Governance, Environmental and Social Responsibility Committee is responsible for developing, overseeing and regularly reviewing our Corporate Governance Guidelines and related policies. The Governance, Environmental and Social Responsibility Committee also: • Serves as a nominating committee, establishing criteria for new Trustees and identifying and recommending prospective Board candidates and the appointment of Trustees to Board Committees. • Annually reviews the independence and qualifications of the Trustees and recommends to the Board appointments of the Committee Members, of the Lead Trustee, and the Chairman of the Board and the election of officers of the Company. • Annually evaluates the performance of the Board and its Committees. • Annually reviews the charters of the Board Committees. • Oversees the Company’s ESG, sustainability, and social responsibility strategy, programs, policies, risks, and performance. Following each Committee meeting, the Governance, Environmental and Social Responsibility Committee reports to the full Board. The Governance, Environmental and Social Responsibility Committee met four times in 2020. Independence: The Board has affirmatively determined that each member of the Governance, Environmental and Social Responsibility Committee meets the independence requirements of the NYSE, the SEC, and our Corporate Governance Guidelines. | | |

In carrying out its charter responsibilities, the Compensation Committee reviews and approves corporate goals and objectives relevant to the Chief Executive Officer's compensation and, with the participation of the Lead Trustee and subject to the further review and approval of the independent Trustees, evaluates the performance of the Chief Executive Officer in light of those goals and objectives. The Committee establishes performance criteria for the Chief Executive Officer and approves the Chief Executive Officer's total compensation based on the annual evaluation, subject to further approval by the independent Trustees. In addition, in collaboration with

the Chief Executive Officer, the Committee oversees the evaluation of those executive officers who under the SEC's regulations are deemed "executives," and it engages in the succession planning process for the Chief Executive Officer and other executives.

The Compensation Committee has retained Pay Governance LLC to provide compensation consulting services. Pay Governance LLC has been engaged to perform work only for the Compensation Committee, and as noted in the Compensation Discussion and Analysis section of this proxy statement, the Compensation Committee has determined that Pay Governance LLC is independent and that no conflict of interest exists that would prevent Pay Governance LLC from independently advising the Committee.

The Compensation Committee has delegated some of its administrative responsibilities to the Chief Executive Officer and the Executive Vice President — Human Resources and Information Technology. The Compensation Committee has not delegated any of its responsibilities to any other persons. The Board has affirmatively determined that each member of the Compensation Committee meets the independence requirements of the NYSE, the SEC, and our Corporate Governance Guidelines. A copy of the Compensation Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-committee-charters/compensation-committee. The Compensation Committee met four times during 2017. The Compensation Committee reports to the full Board following each Committee meeting.

|

The Corporate Governance Committee consists of Ms. Cleveland, Mr. Cloud (Chair), Mr. Doyle, Mr. Gifford, Mr. La Camera and Mr. Wraase. The Corporate Governance Committee is responsible for developing, overseeing and regularly reviewing our Corporate Governance Guidelines and related policies. The Corporate Governance Committee also serves as a nominating committee, establishing criteria for new Trustees and identifying and recommending prospective Board candidates. The Corporate Governance Committee annually reviews the independence and qualifications of the Trustees, recommends nominees for election to the Board and for appointment to Board Committees, and annually recommends to the Board

appointments of the Lead Trustee and Chairman and the election of officers of the Company. In addition, the Corporate Governance Committee evaluates the performance of the Board and its committees. Following each meeting the Corporate Governance Committee reports to the full Board. No member of the Corporate Governance Committee is employed by Eversource Energy or its subsidiaries. The Board of Trustees has determined that each member of the Corporate Governance Committee meets the independence requirements of the NYSE, the SEC, and our Corporate Governance Guidelines. A copy of the Committee's charter is available on our website at

2018 Proxy Statement 17

|

www.eversource.com/Content/general/about/investors/corporate-governance/board-committee-charters/corporate-governance. The Corporate Governance Committee met six times during 2017.

|

The Executive Committee consists of Mr. Cloud, Mr. DiStasio, Mr. Doyle, Mr. Gifford and Mr. Judge (Chair). The Executive Committee is empowered to exercise all the authority of the Board, subject to certain limitations set forth in our Declaration of Trust, during the intervals between meetings of the Board. A copy of

the Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-commitee-charters/executive. The Executive Committee did not meet during 2017.

|

The Finance Committee consists of Ms. Cleveland, Mr. DiStasio (Chair), Mr. La Camera, Mr. Leibler and Ms. Williams. The Finance Committee assists the Board in fulfilling its fiduciary responsibilities relating to financial plans, policies and programs for Eversource Energy and its subsidiaries. The Finance Committee reviews the Company's plans and actions to assure liquidity; proposed financing programs; plans and recommendations regarding common share repurchase programs; early extinguishment and refunding of debt and preferred stock obligations; and other proposals that modify the Company's capital structure. The Finance Committee is responsible for reviewing the Company's Enterprise Risk Management (ERM) program, including practices to monitor and mitigate cyber, physical security and other risk exposures, as further described below under the caption "Board's Oversight of Risk." The Finance Committee is also responsible for

reviewing and recommending the Company's dividend policy, as well as new business ventures and initiatives which may result in substantial expenditures, commitments and exposures. In addition, the Finance Committee conducts an annual review of counter party credit policy, insurance coverages and pension plan performance. Following each meeting, the Finance Committee reports to the full Board. No member of the Finance Committee is employed by Eversource Energy or its subsidiaries. A copy of the Committee's charter is available on our website at www.eversource.com/Content/general/about/investors/corporate-governance/board-committee/charters/finance. The Finance Committee met four times during 2017, and also met once with the Audit Committee in April 2017, at which the Committees discussed several issues relating to risk, and in particular enterprise, cyber and system security risk.

|

No member of the Compensation Committee is employed by Eversource Energy or any of its subsidiaries. No executive officer of Eversource Energy serves as a member of the compensation committee or

on the board of

|

1820 20182021 Proxy Statement

TableGovernance of ContentsEversource Energy

Board’s Oversight of Risk |

|

planning session.

the Company, including compliance, auditing, and insurance, to ensure appropriate coverage of risks that could impact the Company.Company, that the appropriate risk response is determined, and that the risk mitigation plans are periodically reviewed. The top enterprise-wide risks are identified using a comprehensive cross functional analysis working with key officers and employees of each organization within the Company and are monitored throughout the year by the Company’s Risk

20182021 Proxy Statement 1921

TableGovernance of ContentsEversource Energy

|

|

addition, assessments by third-party experts of cyber and physical security risks to the utility industry and the Company in particular are provided periodically. The Company constantlyregularly reviews and updates its cyber and system security programprograms and the Board and its Committees continue to enhance their strong oversight activities, including joint meetings of the Audit and Finance Committees, at which cyber and system security programs and issues that might affect the Company'sCompany’s financial statements and operational systems can beare discussed by both Committees with financial, information technology, legal and accounting management, together withother members of the Board, representatives of the Company'sCompany’s independent registered public accounting firm, and other outside advisors.

|

Environmental,future generations, with environmental, social and governance (ESG) initiatives arefully integrated into the policies and principles that govern our Company and reflectCompany. One important example of our commitment to sustainable growth. We are committed to reliability, effective corporate governance, expanding energy options for our region, and environmental stewardship. Ourcontinued sustainability leadership includes setting a goal is to be the best energy companycarbon neutral in the nation, which includes being the leading clean energy utility and providing transparency and clarity about our position on these topics.

In 2017, we released Eversource's Commitment to Environmental Sustainability, which underscores our environmental priorities and highlights our roleoperations by 2030, while serving as a key catalyst for clean energy development in New England. This statement is an important componentThrough this leadership, we meet the sustainability and ESG expectations of our visionshareholders, customers, employees, regulators and the communities we serve. We are committed to top-tier reliability, superior customer service and effective corporate governance. We are continuously expanding energy options for how we conduct our business today; it is postedregion, have a best in the country energy efficiency program, implement best practices in human capital management and environmental stewardship, and provide transparency and clarity about our position and our performance on our website at www.eversource.com/content/ema-c/about/investors/investor-relations/sustainability-the-environment/commitment-to-environmental-sustainability. these topics. Our policies and programs have been recognized for their excellence throughout the industry and by independent trade groups, sustainability raters and the media.

with institutional investors. In December 2017, the nation's electric companies became the first industry

Set forth below isenabling a listcleaner mix of energy in the considerationsgrid and topics that we feel are important to our comprehensive Sustainability and Corporate Social Responsibility policies and practices, followed by a description of each and how we integrate them into our Company:

20 2018 Proxy Statement

Sustainability Governance. Sustainability reporting at Eversource is managed by a sustainability team, which is overseen by executive level management. Our team meets regularly throughout the year to assess current practices and identify improvement opportunities. All operational and business disciplines are engagedimproving efficiencies in our sustainability reporting process.

Electric Transmission. Since 2001, Eversource has sited and built complex and varied projects in densely populated, congested areas in our service territory. These projects have enhanced the reliability of the electric grid, eased congestion, accelerated retirement of older, higher emission coal and oil-fueled power plants, and helped to provide greater access to new, environmentally-friendly renewable power sources. Over the next four years, Eversource Energy plans to invest approximately $4.1 billion in projects and upgrades to modernize our electric transmission system and meet the region's renewable energy needs. A more reliable, more efficient electric grid will provide New England with the infrastructure that is critical to help the region meet its aggressive greenhouse gas reduction goals. If approved, our proposed $1.6 billion Northern Pass project will allow New England to import up to 1,090 megawatts of clean energy for 40 years beginning in late 2020.infrastructure.

Natural Gas. Our Distribution Integrity Management Programs are designed to improve service for our customers by mitigating potential risks and identifying and prioritizing operational and infrastructure enhancements. Replacement of aging natural gas infrastructure is an example of a top priority to minimize the potential for natural gas emissions and to prevent the release of greenhouse gases into the atmosphere. Over the past five years, we have doubled the pace at which we are replacing older natural gas pipelines in both Massachusetts and Connecticut.

Water. Aquarion Water Company provides water servicesones to residential, commercial, industrial, fire protectionfoster technological solutions to carbon reduction challenges.

annual production is self-supplied and processed at ten surface water treatment plants and numerous well stations, all wholly-owned and located in Connecticut, Massachusetts and New Hampshire.

Energy Efficiency. Delivering clean, efficient energy is oneexpect to grow over the coming decade can contribute significantly to reducing the carbon footprint of our primary goals.service territory and our 4.3 million customers. We are also committed to supporting regional goals addressing climate change. Our long-term strategy is rooted in being a principal catalyst for decarbonizing the grid with clean energy in New England. Our vision to lead our industry in sustainability includes investments in renewable energy sources, like wind and solar power — both of which will play an important role in our region’s clean energy future.

![[MISSING IMAGE: tm212409d1-fc_carbonbwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-fc_carbonbwlr.jpg)

Our nationally recognized energy efficiency portfolio of services provides energy solutions for all Eversource customers —customer classes: residential, (including low-income), municipal, commercial and industrial. These solutions address energy-efficient new construction, weatherization, lighting, appliances, heating, cooling, mechanical and process equipment replacement that go beyond code compliance and are transforming the marketplace. Combined with online customer engagement tools and on-site education, green-job training and community outreach services, energy efficiency is generating savings that go back into our region's economy. These investments are expected to

CorporateEversource Gas Company of Massachusetts. We are actively pursuing ways to incorporate responsible and Compensation Governance.renewable natural gas into our supply portfolio, which will help address customer concerns around environmental stewardship and decarbonization of the service we provide.

Our Employees. We are dedicatedadditional ways to ensuring that all ofleverage our employees receive good pay, are given the tools to perform their jobs safely, have access to affordable healthcare, and can look forward to a happy and comfortable retirement. We also are committed to diversitynatural gas assets in the workplace; Ceres recently commended usfuture for our progress and commitment to diversity, which includes linking executive compensation to increasing leadership-level position diversity.

2018 Proxy Statement 21

|

Our Communities.Water. Eversource is committed to the healthprotection of water resources through conservation, water quality management and economic well-beingwater saving technologies.

We have a long history of partnering with local and regional community organizations. Through grants, we support economic and community development, the environment, and initiatives that address local, high-priority concerns and needs. We provided nearly $16.1 million in grants to nonprofit organizations and worthwhile regional activities across our tri-state service area in 2017. We have strong partnerships with key community organizations across New England, including our continued support of the Eversource Walk for Boston Children's Hospital, the Eversource Hartford Marathon, the Eversource Walk and 5K Run for Easter Seals New Hampshire, the United Way, and Special Olympics.

Northeast by J.D. Power.

Climate Leadership. We have developed meaningful strategies to reduce our carbon footprint,critical resource areas and are proud

to be one of the greenest utilities in the nation. We are a founding partner of the EPA's Natural Gas STAR Methane Challenge Program,

Accountability. We hold ourselves accountable for the impact our business might have on the environment, meeting and in many cases exceeding all environmental laws, and regulatory commitments and requirements.

For additional information on these initiativesemotional pain caused by racism and injustice in our progress to date, you can access the Company's comprehensive sustainability report, which describes in greater detailsociety and know that our commitment to safety, reliability, expanding energy optionsDiversity and Inclusion (D&I) is critical to building an empowered and engaged team that delivers great service safely to our customers. It also calls for greater racial equity and social justice in our communities and workplaces. In 2020, Eversource updated its D&I strategy to include a Racial Equity and Social Justice Plan, with three areas of focus: building a more inclusive workplace, increasing leadership commitment, and further enhancing support for our region, environmental stewardshipdiverse communities and other objectives, throughminority suppliers. We communicated to our employees and stakeholders our commitments to developing a workforce that fully reflects the Company's website at www.eversource.com/content/ema-c/about/investors/investor-relations/sustainability-the-environment/sustainability.

22 2018 Proxy Statement

|

As part of our corporate governance program,the people and communities we engage with many of our institutional shareholders on corporate governance issues,serve. We continue to make progress year over year to become a more diverse and inclusive workplace; as shown in the data that we keep and track as part of our activeEEO-1 reporting compliance, in three years we have increased diversity leadership promotions and hires from 37% to 47.6%, workforce representation of diverse employees from 16% to 18.6%, and diversity slate of candidates from 50% to 57%. We have increased our emphasis on workforce representation of women, and although our progress has

![[MISSING IMAGE: tm212409d1-bc_esgbwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-bc_esgbwlr.jpg)

ESG practicespolicies, and our growing socially responsive investor base. The meetings included a dialogue between usaccomplishments; and the representatives of our shareholders on currentoverall corporate governance and executive compensation policies and practices; the sessions themselves vary according to the issues including proxy access,that are of greatest interest to our holders. Further information is available to all investors on our website in a presentation identified as “Eversource: A Sustainable Investment Opportunity.” Meeting topics have included enterprise risk, Board member refreshment, Board self-assessments, various governance-related provisions contained in our Declaration of Trust, Corporate Governance Guidelines, and Committee charters, stock incentive plan metrics, and general corporate

20182021 Proxy Statement

TableGovernance of ContentsEversource Energy

|

Eversource encourages its employees to be active members of their communities. Along with participation in civic, charitable and volunteer activities, this includes participation in the political process. Eligible employees

water service from any of the utility operating company subsidiaries of Eversource Energy in the ordinary course of business, on an arm'sarm’s length basis and pursuant to rates determined by the applicable public utility commission, are immaterial to the independence of the Trustees.

24 2018 Proxy Statement

completed by each Trustee and on reviews of all transactions involving the Company and all Related Persons conducted by both management and our independent registered public accounting firm, and after applying the NYSE Listing Standards and the Trustee

Independence Guidelines, the Board of Trustees determined that none of the Eversource Related Persons, including the Trustees, has a direct or indirect material interest in any transaction involving the Company or its subsidiaries.

2018 Proxy Statement 25

|

www.eversource.com/Content/docs/default-source/Investors/Code_of_business_conduct.Code_of_business_conduct. You may obtain a printed copy of the Code of Ethics and the Code of Business Conduct, without charge, by contacting our Secretary at the address set forth on page 7274 of this proxy statement. Any amendments to or waivers under the Code of Ethics or the Code of Business Conduct will be posted to our website atwww.eversource.com/Content/general/about/investors/corporate-governance.corporate- governance.

|

at the mailing address set forth on page 7274 of this proxy

2630 20182021 Proxy Statement

TableSecurities Ownership of ContentsCertain Beneficial Owners

|

The following table provides information as to persons who are known to us to beneficially own more than five percent of the common shares of Eversource Energy. We do not have any other class of voting securities.

| | Name and Address of Beneficial Owner | | | Amount and Nature of Beneficial Ownership | | | Percent of Class | | ||||||

| | The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | | | | | 40,913,941(1) | | | | | | 11.93%(1) | | |

| | BlackRock, Inc. 55 East 52nd Street New York, New York 10055 | | | | | 30,408,772(2) | | | | | | 8.9%(2) | | |

| | Magellan Asset Management Limited d/b/a MPG Asset Management MLC Centre, Level 36 19 Martin Place Sydney NSW 2021 Australia | | | | | 25,533,531(3) | | | | | | 7.45%(3) | | |

| | State Street Corporation State Street Financial Center One Lincoln Street Boston, MA 02111 | | | | | 19,603,630(4) | | | | | | 5.72%(4) | | |

| Name and Address of Beneficial Owner | Amount and Nature of Beneficial Ownership | Percent of Class | | |||||

|---|---|---|---|---|---|---|---|---|

| | | | | | | | | |

| The Vanguard Group, Inc. 100 Vanguard Blvd. Malvern, Pennsylvania 19355 | | 33,913,632 | (1) | | 10.7% | (1) | ||

BlackRock, Inc. 55 East 52nd Street New York, New York 10055 | 25,206,815 | (2) | 8.0% | (2) | ||||

| | | | | | | | | |

|

The table below shows the number of our common shares beneficially owned as of March 1, 2018,2021, by each of our Trustees and Named Executive Officers, as well as the number of common shares beneficially owned by all of our Trustees and executive officers as a group. We do not have any other class of voting securities. Together, these individuals beneficially own less than one percent of our outstanding common shares. The table also includes information about restricted share units and deferred shares credited to the accounts of our Trustees and executive officers under certain compensation and benefit plans. The address for the shareholders listed below is c/o Eversource Energy, 300 Cadwell Drive, Springfield, Massachusetts 01104.

| | ||||||||||||

| Name of Beneficial Owner | | | Amount and Nature of Beneficial Ownership(1)(2) | | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| | Gregory B. Butler | | | | | 86,479(3) | | | ||||

| Cotton M. Cleveland | | ||||||||||

| ||||||||||||

| | | 67,054 | | ||||||||

| ||||||||||||

James S. DiStasio | | | 34,408 | | | |||||||

| Francis A. Doyle | |||||||||||

| | | 29,607(4) | | | |||||||

| Linda Dorcena Forry | | | | | 7,669 | | | ||||

| | Gregory M. Jones | | | | | 3,179 | | | ||||

| | James J. Judge | | | | 329,348(3) | | ||||||

| John Y. Kim | | | 23,349 | | | ||||||

| ||||||||||||

Kenneth R. Leibler | | | 42,870 | | | |||||||

| Philip J. Lembo | |||||||||||

| | | | 66,739(3)(5) | | |||||||

| David H. Long | | | | | 5,040 | | | ||||

| | Joseph R. Nolan, Jr. | | | | | 103,982(3) | | | ||||

| | Werner J. Schweiger | | | | 227,590(3)(6) | | ||||||

| William C. Van Faasen | | | 54,016 | | | ||||||

| Frederica M. Williams | |||||||||||

| | 20,916 | | | ||||||||

| All Trustees and Executive Officers as a group | |||||||||||

| | | | | 1,167,228(7) | | | ||||||

2832 20182021 Proxy Statement

|

Section 16(a) of the Securities Exchange Act of 1934 requires the Trustees and executive officers of Eversource Energy and persons who beneficially own more than ten percent of our outstanding common shares to file reports of ownership and changes in ownership with the SEC and the NYSE. We assist our Trustees and executive officers by monitoring

transactions and completing and filing Section 16 reports on their behalf. Based on such reports and the written representations of our Trustees and executive officers, we believe that for the year ended December 31, 2017, all such reporting requirements were complied with in a timely manner.

2018 Proxy Statement 29

|

The Compensation Committee periodically reviews the compensation of our non-employee Trustees and, when it deems appropriate and upon consultation with the Committee'sCommittee’s independent compensation consultant, recommends adjustments to be approved by the Board.Board of Trustees. The Compensation Committee recommends to the Board of Trustees compensation for the Trustees based on competitive market practices for both the total value of compensation and the allocation of cash and equity. The Committee uses data obtained from similarly sized utility and general industry companies as guidelines for setting Trustee compensation. The level of Trustee compensation recommended by the Committee and approved by the Board enables us to attract Trustees who have a broad range of backgrounds and experiences.

year, consisting of the number of restricted stock units (RSUs) resulting from

| | |||||

| Compensation Element | |||||

|---|---|---|---|---|---|

| | | Amount | | ||

| Annual Cash Retainer | | | $ | |

| Annual Stock Retainer | | | $ | |

| Board and Committee Attendance Fees | | | None | |

| Annual Lead Trustee Retainer | | | $ | |

| Annual Committee Chair Retainer | ||||

| |||||

| |||||

| |||||

| | | $25,000 Audit Committee $15,000 Compensation Committee $15,000 Governance, Environmental and Social Responsibility Committee $15,000 Finance Committee | |

Pursuant to the Company's Deferred Compensation Plan, priorPrior to the year earned, each Trustee may also irrevocably elect to defer receipt of all or a portion of their cash

30 20182021 Proxy Statement

| | Trustee | | | Fees Earned Or Paid in Cash ($)(1) | | | Stock Awards ($)(2) | | | Total ($) | | |||||||||

| | Cotton M. Cleveland | | | | $ | 125,000.00 | | | | | $ | 166,606.56 | | | | | $ | 291,606.56 | | |

| | Sanford Cloud, Jr.(3) | | | | | 80,000.00 | | | | | | 166,606.56 | | | | | | 246,606.56 | | |

| | James S. DiStasio | | | | | 130,000.00 | | | | | | 166,606.56 | | | | | | 296,606.56 | | |

| | Francis A. Doyle | | | | | 140,000.00 | | | | | | 166,606.56 | | | | | | 306,606.56 | | |

| | Linda Dorcena Forry | | | | | 115,000.00 | | | | | | 166,606.56 | | | | | | 281,606.56 | | |

| | Gregory M. Jones | | | | | 76,666.67 | | | | | | 115,361.84 | | | | | | 192,028.51 | | |

| | John Y. Kim | | | | | 115,000.00 | | | | | | 166,606.56 | | | | | | 281,606.56 | | |

| | Kenneth R. Leibler | | | | | 115,000.00 | | | | | | 166,606.56 | | | | | | 281,606.56 | | |

| | David H. Long | | | | | 115,000.00 | | | | | | 166,606.56 | | | | | | 281,606.56 | | |

| | William C. Van Faasen | | | | | 150,000.00 | | | | | | 166,606.56 | | | | | | 316,606.56 | | |

| | Frederica M. Williams | | | | | 115,000.00 | | | | | | 166,606.56 | | | | | | 281,606.56 | | |

Trustee | Fees Earned Or Paid in Cash ($)(1) | Stock Awards ($)(2) | Total ($) | |||||||

| | | | | | | | | | | |

John S. Clarkeson | | 100,000 | | 136,625.44 | | 236,625.44 | ||||

Cotton M. Cleveland | 100,000 | 136,625.44 | 236,625.44 | |||||||

Sanford Cloud, Jr. | | 140,000 | | 136,625.44 | | 276,625.44 | ||||

James S. DiStasio | 112,500 | 136,625.44 | 249,625.44 | |||||||

Francis A. Doyle | | 117,500 | | 136,625.44 | | 254,125.44 | ||||

Charles K. Gifford | 112,500 | 136,625.44 | 249,125.44 | |||||||

Paul A. La Camera | | 100,000 | | 136,625.44 | | 236,625.44 | ||||

Kenneth R. Leibler | 100,000 | 136,625.44 | 236,625.44 | |||||||

Thomas J. May(3) | | 50,000 | | 136,625.44 | | 186,625.44 | ||||

William C. Van Faasen | 100,000 | 136,625.44 | 236,625.44 | |||||||

Frederica M. Williams | | 100,000 | | 136,625.44 | | 236,625.44 | ||||

Dennis R. Wraase | 100,000 | 136,625.44 | 236,625.44 | |||||||

| | | | | | | | | | | |

20182021 Proxy Statement 31

|

follow.

| | |||

➢ Summary of 2020 Accomplishments ➢ Pay for Performance Philosophy | |||

➢ Executive Compensation Governance | |||

➢ Named Executive Officers | |||

➢ Overview of | |||

➢ Market Analysis | |||

➢ Mix of Compensation Elements ➢ Risk Analysis of Executive Compensation ➢ Results of 2020 Say on Pay Vote ➢ Elements of | |||

| | ➢ 2020 Annual Incentive Program | |

| ||||

| ||||

and Retention Requirements | ||||

➢ Contractual Agreements | ||||

➢ Tax and Accounting Considerations | ||||

➢ Equity Grant Practices ➢ Compensation Committee Report | |

|

2020:

32 2018 Proxy Statement

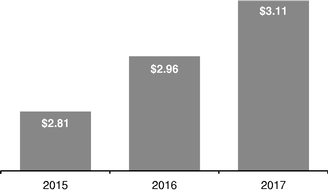

Set forth below is information relating to key financial metrics over the past three to five years:

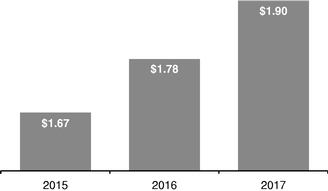

Earnings Growth – 2015 - 2017 recurring2020 earnings per share have grown 5.5% on average, consistent with our long-term earnings guidanceequaled $3.55 per share, and above the utility industry average.

Recurringnon-GAAP earnings per share equaled $3.64; non-GAAP earnings excludes transactional costs relating to the highly successful acquisition in 2020 of the assets of Columbia Gas of Massachusetts (Columbia Gas).(1)

Dividend Growth – As a result of our continuing strong earnings growth, the The Board of Trustees increased the annual dividend rate by 6.7%6.1 percent for 20172020 to $1.90$2.27 per share, which exceedsexceeded the EEI Index companies' median dividend growth rate of 4.8%. The dividend growth rate4.5 percent for the period 2015 - 2017 has averaged 6.6%, well ahead ofutilities that constitute the utility industry average.Edison Electric Institute Index (EEI Utility Index).

![[MISSING IMAGE: tm212409d1-bc_dividendbwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-bc_dividendbwlr.jpg)

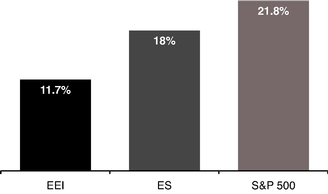

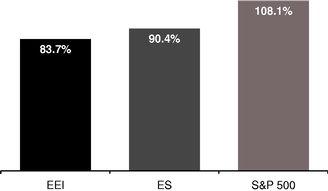

Total Shareholder Return – Our Total Shareholder Return (TSR) in 20172020 was 18%,4.5 percent, compared to the 11.7% growth ofnegative 1.2 percent for the EEI Index, companies and 21.8% for the S&P 500. We also outperformed5th highest TSR in the EEI Utility Index companiesof 39 companies. We have continued to outperform the EEI Utility Index over 2013 - 2017.the last one-, three-, five- and 10-year periods and the Standard & Poor’s 500 over the last three- and 10-year periods. An investment of $1,000 in our common shares atfor the beginning of the five-year10-year period beginning January 1, 20132011 was worth $1,904$3,726 on December 31, 2017.

2020. The following charts representchart represents the comparative one- and five-year total shareholder returns for the periods endingended December 31, 2017, respectively:

2020:

| | Total Shareholder Return | | | 2020 | | | 3-Year | | | 5-Year | | | 10-Year | | ||||||||||||

| | Eversource | | | | | 4.5% | | | | | | 49.4% | | | | | | 96.8% | | | | | | 272.6% | | |

| | EEI Index | | | | | -1.2% | | | | | | 28.9% | | | | | | 69.1% | | | | | | 190.0% | | |

| | S&P 500 | | | | | 18.4% | | | | | | 48.9% | | | | | | 103.0% | | | | | | 267.0% | | |

CREDIT RATING:Five-Year Cumulative Shareholder Return We continue to hold an A- level Corporate Credit Rating at Standard & Poor’s. There is no other holding company with a higher credit rating in the EEI Utility Index.

2017 Operational Accomplishments

![[MISSING IMAGE: tm212409d1-bc_reliabilbwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-bc_reliabilbwlr.jpg)

![[MISSING IMAGE: tm212409d1-bc_restorabwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-bc_restorabwlr.jpg)

![[MISSING IMAGE: tm212409d1-bc_safetybwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-bc_safetybwlr.jpg)

![[MISSING IMAGE: tm212409d1-bc_gasbwlr.jpg]](https://capedge.com/proxy/DEF 14A/0001104659-21-042415/tm212409d1-bc_gasbwlr.jpg)

2018 Proxy StatementEMPLOYEES/HUMAN CAPITAL MANAGEMENT: 33

|

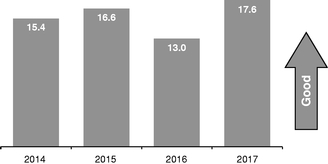

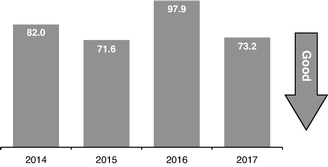

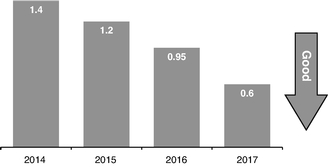

Set forth below is information relating to key operational metrics over the past four years.

Reliability – Electric System Reliability, which is measured by months between interruptions and average time to restore power, wasbe included in the first quartile of our industry, with our best results ever for the lowest number and frequency of interruptions.

Reliability PerformanceMonths Between Interruptions

Safety performance, measured by DART per 100 workers, improved significantly; performance wasBloomberg Gender-Equality Index, which recognizes companies who have shown their commitment to advancing women’s equality in the first quartileworkplace and transparency in gender reporting.

indicators that address environmental, social and governance matters.Safety PerformanceDays Away or Restricted Time/100 Workers

|

executives in a manner that aligns compensation directly with performance. We strive to provide executives with base salary, performance-based annual incentive compensation, and performance-based long-term incentive compensation opportunities that are competitive with market practices and that reward excellent performance.

34 2018 Proxy Statement

| |

| | ||

What we DO: | ||

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

|

| |

| | ||

What we | ||

|

| |

|

| |

|

| |

|

| |

|

| |

reimburse the Company for incentive compensation received, not only if earnings wereare subsequently required to be restated as a result of noncompliance with accounting rules caused by fraud or misconduct, but also if there had beenfor a willful material violation of our Code of Business Conduct or materialsignificant breach of a material covenant in an employment agreement. The Plan also imposes limits on awards and on Trustee compensation and prohibits repricing of awards and liberal share recycling.

|

|

program for those senior executive officers, whom we refer to in this CD&A as "executives"“executives” and whom are deemed to be "officers"“officers” under the SEC'sSEC’s regulations

2018 Proxy Statement 35

|

that determine the persons whose compensation is subject to disclosure. In this role, the Committee sets compensation policy and compensation levels, reviews and approves performance goals and evaluates executive performance. Although this discussion and analysisCD&A refers principally to compensation for the Named Executive Officers, the same compensation principles and practices apply to all executives. The compensation of the Chief Executive Officer is subject to the further review and approval of all of the independent Trustees.

obtained from utility and general industry surveys and a specific group of peer utility companies. LevelsIncumbent compensation levels may be lower thanset below the market median for those executives who are new to their roles, while long-tenured, high performing executives may be compensated above median. The review by Pay Governance performed in late 2017December 2020 indicated that the Company'sCompany’s aggregate executive compensation levels werecontinue to be aligned with median market rates.

Pay Governance Independence. In February 2018,2021, the Committee assessed the independence of Pay Governance pursuant to SEC and NYSE rules, and concluded that it is independent and that no conflict of interest exists that would prevent Pay Governance from independently advising the Committee. In making this assessment, the Committee considered the independence factors enumerated in Rule 10C-1(b) under the Securities Exchange Act of 1934, includingas well as the written representations of Pay Governance that Pay Governance does not provide any other services to the Company, the level of fees received from the Company as a percentage of Pay Governance'sGovernance’s total revenues, the policies and procedures employed by Pay Governance to prevent

36 2018 Proxy Statement

|

| | | |||||||||

| Alliant Energy Corporation | | | Dominion Energy, Inc. | | | Pinnacle West Capital Corporation | | | ||

| | | Ameren Corporation | | | DTE Energy Company | | | PPL Corporation | | |

| | ||||||||||

| | American Electric Power Co., Inc. | | Edison International | | Public Service Enterprise Group, Inc. | | | |||

| | | CenterPoint Energy, Inc. | | Entergy Corporation | | | Sempra Energy | | | |

| | | CMS Energy Corp. | | FirstEnergy Corp. | | | WEC Energy Group, Inc. | | | |

| | | Consolidated Edison, Inc. | | NiSource, Inc. | | | Xcel Energy Inc. | |||

| | |

The Committee also determines perquisites to the extent they serve business purposes, and sets supplemental benefits at levels that provide appropriate compensation opportunities to the executives.

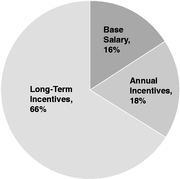

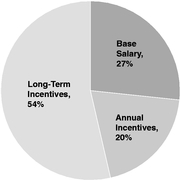

heavily weighted toward incentive compensation, and incentive compensation is heavily weighted toward long-term compensation. Since our most senior positions have the greatest responsibility for implementing our long-term business plans and strategies, a greater proportion of total compensation is based on performance with a long-term focus.

2018 Proxy Statement 37

|

| | | | | Percentage of TDC at Target | | | | | | | | |||||||||||||||||||||

| | | | | | | | | | | | | | | | | Long-Term Incentives | | | | | | | | |||||||||